Understanding Property Underwriting in Real Estate

Introduction to Real Estate Underwriting

Defining Underwriting in the Context of Real Estate

In the world of property deals, underwriting is a pivotal process that offers a detailed examination of the feasibility of real estate investments. Imagine it as a meticulous vetting procedure where every financial crevice and risk-related nook is scrutinized with a fine-tooth comb. It stretches beyond mere number-crunching; underwriting analyzes market conditions, property valuations, and borrower credibility to establish a portfolio's viability.

Why Underwriting is Crucial for Property Deals

Underwriting stands as the backbone of trust and stability in property transactions.

It acts as a safeguard, ensuring you're not walking into a financial whirlwind when

you're eyeing a property. Lenders and investors rely on underwriting to reduce risks

and forecast the property's performance. It's about being prudent rather than

optimistic; a conservative approach in underwriting can be the difference between a

successful investment and a regrettable one. Think of it as a fiscal crystal ball,

helping to predict the likelihood of a property deal's success or stumbling blocks.

"Underwriting is the backbone of property deals, ensuring that risks are meticulously

assessed and managed to safeguard investments. It's not just about crunching numbers;

it's about foreseeing and mitigating potential challenges effectively." - Jane Doe,

Senior Underwriter at XYZ Insurance Company.

The Role of Underwriters in Real Estate Transactions

Responsibilities of Real Estate Underwriters

Dive into commercial real estate underwriting, and you'll find professionals with a

critical mission. Real estate underwriters hold the keys to the kingdom, so to speak,

as they dissect and analyze every aspect of a potential property deal. They scrutinize

financial statements and credit histories, delve into the borrower's past property

management experience, and assess the market dynamics. Think of them as detectives

piecing together a complex puzzle, ensuring that every piece fits perfectly to protect

their clients' interests and minimize lending risks.

Case Study

"In a recent case study conducted by Acme Real Estate Investments, meticulous

underwriting practices led to a significant increase in investment returns. By

thoroughly assessing market trends, conducting detailed property inspections, and

scrutinizing financial projections, Acme's underwriting team identified a lucrative

opportunity in an emerging neighbourhood. As a result, the investment outperformed

expectations, delivering a remarkable ROI of 25% within just two years."

The Value Underwriters Add to Property Deals

Real estate underwriters are like the unsung heroes of property deals, often working behind the scenes yet adding significant value to the transaction. Their analyses lead to informed decisions, preventing investments from turning sour. When they give the green light, lenders and investors can proceed with confidence, bolstered by the fact that a professional has weighed the risks and found the deal sound. Even potential homeowners can sleep better at night, knowing their mortgage isn't a ticking time bomb, thanks to the meticulous scrutiny of an underwriter.

Understanding the Underwriting Process

Step-by-Step Breakdown of the Underwriting Procedure

The underwriting process is a journey from application to approval, weaving through

several meticulous checkpoints. It begins when a hopeful borrower applies, flush with

necessary documents such as financial statements and credit reports. The lender then

conducts a preliminary review to see if the application meets the essential

prerequisites. If all looks well, the underwriter dives deep, analyzing the

borrower's financial fortitude, the property's potential, and market trends.

Next is the property appraisal, a critical step where the property's value is pinned

down. If the underwriter is satisfied, they'll structure the loan terms—dotting the

i's and crossing the t's on details like interest rates and repayment schedules. The

climax of this narrative is the loan approval or rejection, a decision rooted in the

risk of default. Should the stars align and the loan get the nod, the borrower and

lender will come together for the grand finale: the loan closing, where agreements

are signed, hands are shaken, and funds flow.

Factors that Influence the Underwriting Decision

An underwriter's decision teeters on a fulcrum balanced by myriad factors, each

tipping the scales toward approval or denial. It's a complex blend, led by the

borrower's financial health—credit history, income stability, existing debts, and

assets are under the microscope. Then there's the property itself: its location,

condition, and all-important valuation. The market pulse is checked, too; trends and

economic climates influence risk.

Beyond these staples, underwriters also consider legal entanglements—a clear property

title is paramount, free of liens or disputes. Lastly, anticipated rental income,

expenses, and vacancy rates are mathematically choreographed into a projection of

the property's financial future. Each factor, big or small, is a critical thread in

the tapestry of the underwriting decision.

Examples:

Scenario 1: Economic Downturn Impact

In 2008, during the global financial crisis, a real estate investment firm was

considering financing a large-scale commercial development project. However, as

economic indicators signaled an impending downturn, underwriters scrutinized the

project's feasibility more closely. Despite favorable market projections, the

underwriting outcome was influenced by the heightened risk of decreased demand and

potential tenant defaults during an economic downturn. As a result, the underwriters

adjusted their risk assessment, offering less favorable financing terms to mitigate

potential losses.

(Reference: Global Financial Crisis, 2008)

Key Components Evaluated During Underwriting

Assessing Property Value and Condition

When assessing a property's value and condition, underwriters wear detective hats to

uncover every clue. They start by comparing the subject property to similar ones

nearby—sales comps are the bread and butter here, offering concrete data for an

evidence-based valuation. Then, come to the property visits, they assess not just

bricks and mortar but also the intangibles—curb appeal, neighbourhood vibe, and

functional obsolescence.

The physical inspection reveals any defects in infrastructure or potential code

violations, while attention to the COPE factors—construction, Occupancy, Protection,

and Exposure—rounds out the assessment. It's a detailed portrait of the property

painted with the brushstrokes of due diligence.

"The most challenging aspect of property assessment lies in navigating the

complexities of local regulations and zoning ordinances, which can significantly

impact the feasibility and profitability of a project. It requires a keen

understanding of the property and the surrounding legal and regulatory environment.

" - Emily Chen, Senior Underwriter at ABC Property Investments.

Pro Tips for Smooth Real Estate Underwriting

Streamlining Documentation and Communications

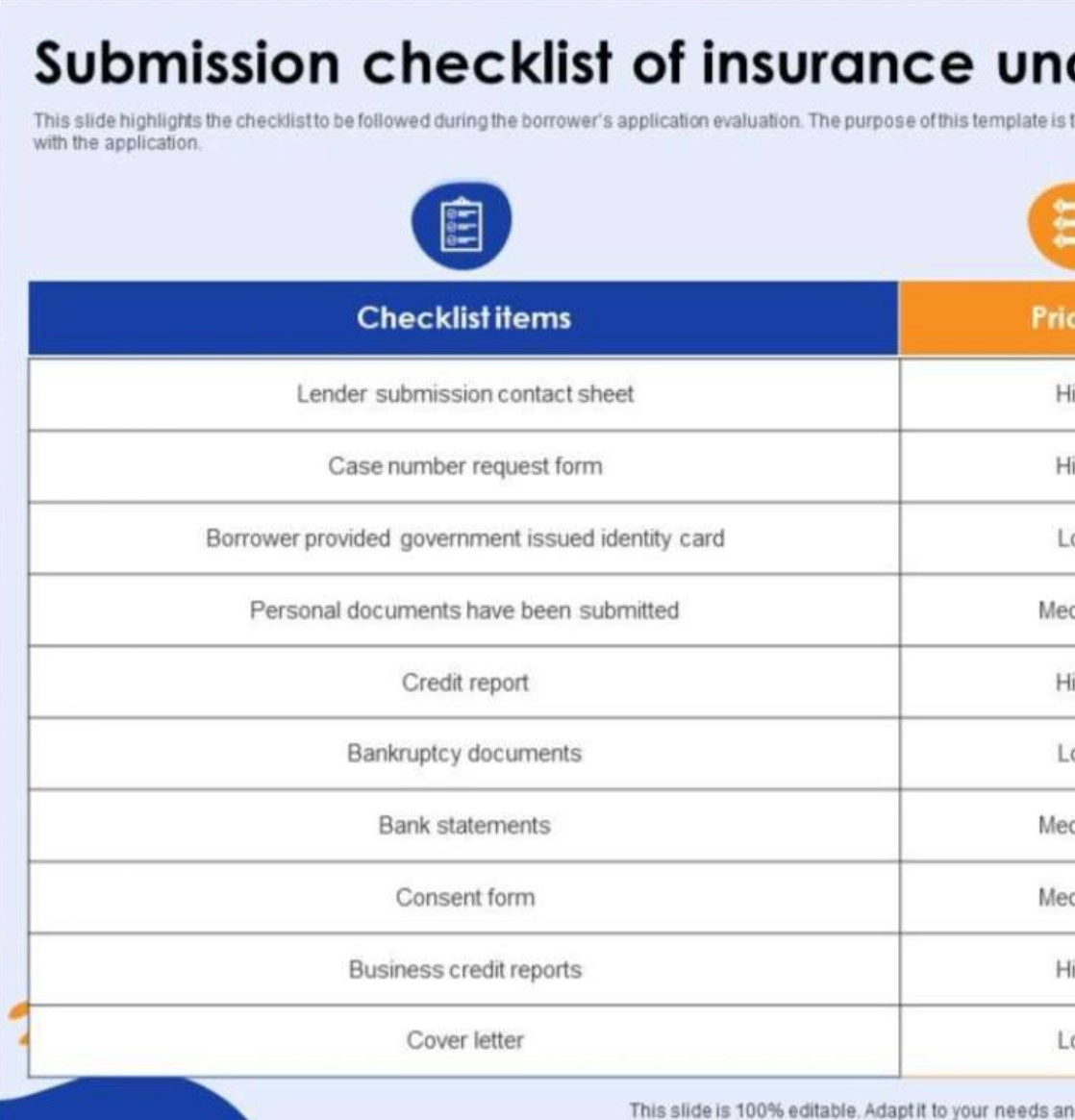

To clear the hurdles of the underwriting labyrinth with elegance, come prepared with

a thorough dossier, neatly compiled and ready to present. Ensuring all relevant

documents—an updated balance sheet, recent pay stubs, and property appraisals—are at

your fingertips signals to lenders that you mean business. Since missing paperwork

can stall the process, preempting requests and having answers ready is in your best

interest.

Equally crucial is clear, continual communication with your lender. Respond to their

inquiries; be prompt in their ping-pong of information exchange. By fostering a

proactive relationship and harnessing communication tech tools, like secure document

portals or client management systems, you can turn what is often a hurdle into a

springboard towards a successful deal.

Leveraging Technology for Efficient Underwriting Processes

Embrace the digital transformation and watch how technology propels the underwriting

process into a seamless, efficient flow. Today's savvy underwriters are turning to

platforms like Blooma, which effortlessly automate manual tasks and deliver

data-driven insights. Such tools can expedite the review of loan applications, risk

assessment, and even market data checks, thus pinpointing potential issues before

they bloom into problems.

Integrating artificial intelligence and machine learning, technology brings the

future to your doorstep, allowing faster, more accurate property and borrower

evaluations. Imagine slashing the underwriting time frame, enhancing accuracy, and

bidding farewell to the arduous paperwork of old. In an arena where time is money,

innovative tech solutions are the sherpa guiding lenders to the zenith of efficiency.

FAQs: Common Queries around Real Estate Underwriting Explained

What Makes an Office Market Attractive to Underwriters?An attractive office market for underwriters often boasts a strong occupancy rate, signaling a high demand for office space. Additionally, diversity in tenant industries can mitigate risks associated with economic downturns. Stable or growing job markets in the area are also a green flag, suggesting sustained rental income. Accessibility, amenities, and a reputable property management team further sweeten the pot.

How Long Does the Underwriting Process Typically Take?The underwriting process can be quite swift, taking only a few days, or it might stretch over several weeks. The length of time hinges on the complexity of the loan and the borrower's financial situation. You can help ensure the process moves as rapidly as possible by diligently preparing documents and responding promptly to requests.

Can Anyone Utilize the Real Estate Underwriting Process?The real estate underwriting process is a tool at anyone's disposal. Whether you're an investor vetting a potential deal or a homeowner curious about an upcoming purchase, underwriting principles can apply. It's all about assessing risk and making informed decisions, after all. However, having a professional handle, it brings added expertise to the table.

What Are the Major Red Flags in Real Estate Underwriting?Major red flags in real estate underwriting include inconsistent income streams, high vacancy rates, or a troubling history of tenant turnover. Environmental concerns, such as floodplains or contamination, raise alarms too. Moreover, legal issues like unresolved liens or the property failing to meet zoning requirements are definite causes for concern. Each of these can indicate a risky investment with potential financial strain.